Government of Guam Retirement Fund

FY 2005 Financial Highlights

June 8, 2006

The FY 2005 financial audit of the Government of Guam Retirement Fund (Fund), conducted by independent auditors Burger and Comer, reported an increase in plan net assets of $52.6 million to $1.485 billion. Of this amount, $1.357 billion are assets exclusively set aside for the defined benefit (DB) plan, while $128 million are set aside for the defined contribution (DC) plan. The investments produced a rate of return of 10.1% compared to last fiscal year’s 9.3%.

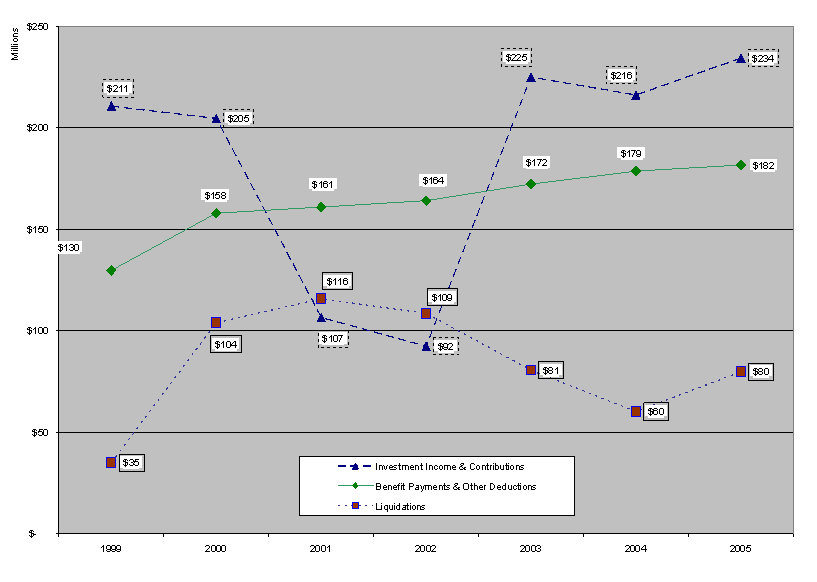

Additions to the retirement plan are represented by investment income and contributions from employers and employees. Total additions in 2005 was $234 million, of which $136.3 million came from investment income after investment expenses of $3.3 million, while employer contributions were $71 million and employee contributions were $27 million.

Deductions totaling $181.7 million are represented by benefits to retirees, withdrawals, transfers to the DC plan, and general and administrative expenses. For FY 2005, total benefits paid to retirees was $161.7 million compared to $156.7 million in FY 2004, withdrawals and transfers out of the DB and DC plan amounted to $15.9 million, and general and administrative expenses were $4 million. Of the $4 million, $2.9 million and $1.1 million were for the DB and DC plans, respectively. As of FY 2005, there were 4,953 DB retirees, 4,502 actives, 1,018 surviving spouses, and 460 disability retirees. There were 5,685 DC retirees.

The Fund realized an increase in the fair value of its investment portfolio of $66 million to $1,354 billion. The Fund continues its shift to investments in common stocks, accounting for $641.6 million of its total portfolio, or 47% .

The Fund liquidated $79.8 million in assets in FY 2005 in order to meet its obligations for benefit payments. Liquidations since FY 1999 have totaled $584 million in corpus and interest. Although the Fund has increased its assets available for benefits in FY 2004 and FY 2005, the liquidations were necessary to meet benefit payments, thus diminishing the Fund’s income-earning assets. The chart below shows the Fund’s investment income/contributions and benefit payments and other deductions since FY 1999. Benefit payments will continue to rise with the aging of active members. Benefits and other deductions have increased from $130 million in 1999 to $182 million in 2005, or an increase of an average of 6% each year.

The Fund continues to hold significant receivables for Supplemental/COLA benefits paid to retirees. The Fund has $164.3 million in total receivables, including $94.1 million for Supplemental/COLA and insurance benefits receivable, $19.2 million from the Early Retirement Incentive Program (ERIP), and $23.5 million from employer/employee contributions. The $92.2 million due from the government of Guam for retirees’ Supplemental/COLA benefits paid by the Fund since FY 1999 is $4.3 million less than last year due to an annual amortization of 1.2% of employer contributions. Based on current rate of amortization, the receivables from Supplemental/COLA will be paid off in approximately 22 years.

In FY 2003, the Fund advanced $9 million for supplemental benefits on behalf of government agencies pursuant to Public Law 26-152 until December 2002. A court order prohibited the Fund from advancing additional supplemental payments. As of FY 2005, this receivable is now reduced to $2 million after collections from various agencies.

There are still outstanding receivables under the Defined Benefit Plan for both employer and employee contributions for the Department of Education, now the Guam Public School System (GPSS), and the Guam Memorial Hospital (GMH). GPSS owes retirement contributions from FY 2003 of approximately $13.7 million and GMH owes $7.6 million, excluding penalties and interests. In addition, GMH still owes $5.5 million on a 1998 promissory note of which the Fund established a reserve equal the balance of the receivable. In FY 2005, GMH paid $285,000 towards the repayment of this note.

In June 2005, the passage of P.L. 28-38 required the Treasurer of Guam to remit interest-only monthly payments of $193 thousand and $190 thousand for and on behalf of GPSS and GMH, respectively, until the outstanding balances for these agencies are fully paid.

The Fund’s FY 2005 report on compliance and internal controls had one current year finding, three less than last year. The Fund has one Reportable Condition under Finding No. 2001-17 relating to a significant deficiency in the reconciliation of DC Plan general ledger accounts. Prior year findings that were repeated include two from FY 2004 and four from FY 2002.

See Management’s Discussion and Analysis for further details.