Tourist Attraction Fund

FY 2005 Financial Highlights

June 26, 2006

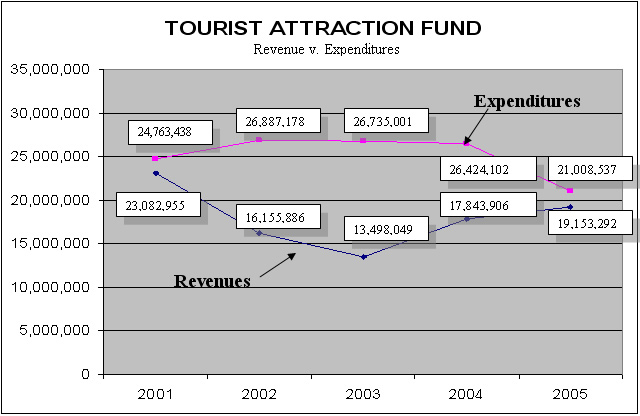

The FY 2005 Tourist Attraction Fund (TAF) audit was conducted by Deloitte & Touche, LLP. Total revenue, primarily derived from hotel occupancy taxes, increased from the previous year for the second year in a row to $19.1 million, up from FY 2004 $17.8 million for a 7.3% increase. This is, however, still short of the five year high of $23 million from FY 2001. See chart below.

Expenditures continue to exceed revenues. Expenditures for FY 2005 totaled $21 million, a decline of $5.4 million from FY 2004. Major areas of expenditures were payments of $10.2 million to Guam Visitor’s Bureau for their FY 2005 operations; capital outlay of $3.5 million; and $7.3 million for debt service.

The TAF has a net deficit of $2.4 million. The operating fund of the TAF has no cash and now owes $3.9 million to the General Fund. The Capital Projects Fund showed a surplus of $12 million that is restricted mainly for implementing infrastructure improvement projects and paying the cost of bond issuance and letter of credit fees. The Debt Service Fund also had a surplus of $13.8 million restricted in accordance with the bond indenture.

The Independent Auditors’ Report on Compliance and on Internal Control had three findings compared to one in the FY 2004 report. The first finding was that occupancy taxes were found to be understated by $368,842. The second finding had an October 2005 deposit of $2,160,275 incorrectly recorded as a deposit in transit as of September, 2005. The third finding related to an un-adjusted interfund balance between the TAF and Debt Service Fund in the amount of $19,794,186.